1. What Is BasicSwap DEX?

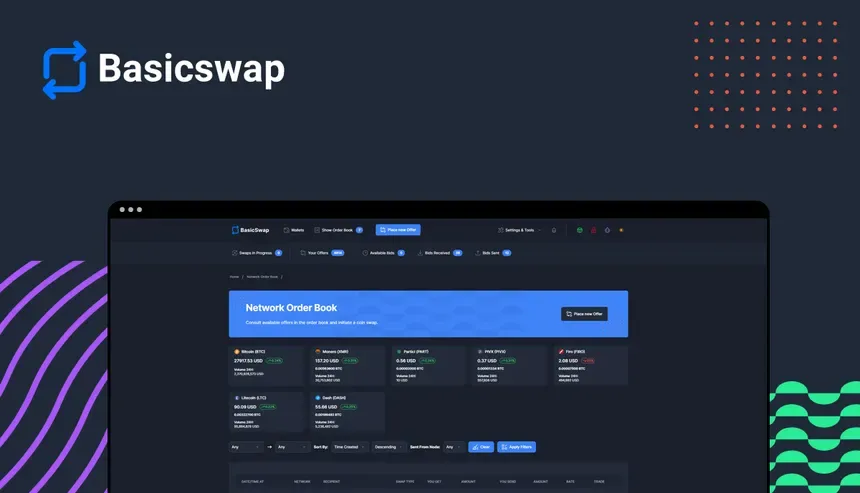

BasicSwap is an open‑source, trustless, cross‑chain atomic‑swap decentralized exchange (DEX) created by the Particl community. It combines:

- Order book replicated over the Particl and BitMessage networks.

- HTLC‑based atomic swaps enabling direct BTC ↔ XMR, BTC ↔ PART, LTC ↔ XMR, etc., without custodians or wrapped tokens.

- Privacy & censorship resistance by routing comms over Tor and BitMessage, and by leveraging Particl’s Confidential Transactions for PART trades.

Unlike Bisq (multisig escrow with deposits), BasicSwap relies on hash‑time‑locked contracts; no third‑party mediators or escrow deposits are needed. If a swap participant disappears mid‑process, funds automatically return to the original owners after a timeout. Though it's popularirity is on a downward trend, liquidity is scarce we're not sure if it's just getting started or abandoned.

2. Key Concepts You Should Understand

2.1 Atomic Swaps in a Nutshell

An atomic swap is a two‑transaction protocol:

- Party A locks Coin X into an HTLC that can be redeemed with secret

S(hash pre‑image) withinT1blocks or refunded after. - Party B uses the hash of

Sto lock Coin Y into a second HTLC with shorter timeoutT2(T2 < T1). - When B redeems Coin X, they reveal

Son‑chain; A usesSto redeem Coin Y. - If either side aborts, the refund paths trigger after timeouts.

2.2 BasicSwap Daemon & GUI

- basicswapd — Python service orchestrating wallets, order book sync, and swap negotiations.

- Electron/Qt GUI — optional front‑end that talks to the daemon via JSON‑RPC.

2.3 Supported Chains (July-2025)

| Ticker | Tech | Requirements |

|---|---|---|

| BTC | Bitcoin Core ≥ 27 | Full node or Electrs proxy. |

| XMR | Monero-daemon/wallet ≥ 0.19 | Full node (7–20-GB) or remote node (less private). |

| PART | Particl Core ≥ 0.21 | Required for default order book overlay. |

| LTC, DCR, Firo, etc. | Varies | See BasicSwap docs. |

2.4 Order Book Distribution

Orders propagate via:

- Particl’s p2p network (OP_RETURN messages)

- BitMessage channels (legacy fallback)

- IPFS (experimental)

No central server, but order discovery can take a few minutes after startup.

3. System Requirements & Prep

| Component | Minimum | Recommended |

|---|---|---|

| OS | Linux 64‑bit | Debian/Ubuntu LTS or Arch. Docker works too. |

| Storage | 40-GB (pruned nodes) | 300 GB+ if full Bitcoin chain. |

| RAM | 4 GB | 8–16 GB for parallel nodes. |

| Network | Unrestricted inbound/outbound | Port 8449 TCP open improves liquidity discovery (optional). |

Security‑minded? Use a dedicated machine or VPS with encrypted disks. Always run over Tor (built in) or Tailscale exit.

4. Installing BasicSwap

4.1 Quick Start via Docker Compose

git clone https://github.com/particl/basicswap.git && cd basicswap

cp docker/.env.sample .env # edit RPC usernames/passwords if needed

docker compose up -d

Services started:

basicswapd(Python)- Bitcoin Core, Monero

monerod, Particl d, Electrum servers (optional)

4.2 Manual (Bare‑Metal) Install

- Install system deps:

git,python3.11,virtualenv,rustup(for some cryptography bindings). - Clone repo:

git clone https://github.com/particl/basicswap && cd basicswap. - Create venv:

python -m venv venv && source venv/bin/activate. pip install -r requirements.txt.- Copy

basicswap.conf.example → basicswap.confand edit paths to your Bitcoin/Monero/Particl data dirs & RPC creds. - Run

python basicswap/run.py --initto generate wallet seeds for each chain.

4.3 Verify Binaries & Signatures

Download Core binaries from official projects; verify PGP signatures (Bitcoin Core, Monero).

5. First‑Run Configuration

5.1 Edit basicswap.conf

Key sections:

[BASE]

network = mainnet

listen = 127.0.0.1:12700

use_tor = 1

[bitcoin]

rpc_user = user

rpc_password = pass

rpc_port = 8332

rpc_host = 127.0.0.1

[monero]

rpc_user = foo

rpc_password = bar

rpc_host = 127.0.0.1

rpc_port = 18081

[particl]

...

Enable or disable coins by adding/removing sections.

5.2 Start Nodes

Ensure bitcoind, monerod, particld are syncing. For test‑drive, you can run them in pruned mode:

bitcoind -prune=550

Monero has its own --prune-blockchain flag.

5.3 Launch basicswapd

./basicswap/scripts/start.sh

# or inside venv

python basicswap/run.py

Logs appear in ~/.basicswap/logs/; wait for ORDERBOOK_SYNCED message.

6. Funding Wallets

Each chain wallet is created automatically on first run. Find deposit addresses:

curl -s --user admin:pass http://127.0.0.1:12700/json | jq .

# or use GUI → Wallets tab → Receive

Send a small amount of each asset you plan to swap. Wait for standard confirmations (BTC = 1–3, XMR = 10 blocks, PART = 10).

7. Creating or Taking an Offer

7.1 Take an Existing Offer (Simplest)

- In GUI: Market tab → choose pair (e.g., BTC/XMR).

- Review orderbook rows: Amount, Price, Min/Max, Maker fee.

- Click Take Offer → confirm terms.

- GUI shows swap progress (6 phases). Do not close the daemon until complete.

7.2 Post a New Offer (Maker)

RPC example:

curl --user admin:pass \

-d '{"method":"offerscreate","params":{"from":"btc","to":"xmr","amountfrom":0.01,"amountto":1.3,"minswap":0.002,"lockhours":24,"addrto":"48...xmr"}}' \

http://127.0.0.1:12700/json

- lockhours controls HTLC refund timeout (24 h common; shorter = tighter).

- Offer propagates within ~2 min.

8. Swap Lifecycle Deep Dive

- Negotiation – Maker & taker exchange public keys, addresses, secret hash.

- Lock TX 1 – Maker locks coin_from in HTLC.

- Lock TX 2 – Taker locks coin_to with shorter timeout.

- Redemption – The party receiving coin_from redeems, revealing secret.

- Counter‑Redeem – Other side uses secret to redeem coin_to.

- Done – Both have desired asset; GUI marks swap ✅.

- Timeout path – If step 3 or 4 fails, refund after

lockhours.

9. Fees & Economics

| Fee Type | Paid In | Payer | Typical Amount |

|---|---|---|

| Maker lock TX | chain fee | Maker | On‑chain miner fee. |

| Taker lock TX | chain fee | Taker | Slightly higher (two TXs). |

| Service fee | PART (optional) | Either | 0.25 % default; paid to Particl staking addr. Adjustable → 0. |

Because BasicSwap has no escrow deposits, on‑chain miner fees dominate. Optimize by batching funding UTXOs and watching mempool.

10. Troubleshooting Common Issues

| Symptom | Cause | Fix |

|---|---|---|

Sync stuck at LOADINGOFFERS |

Particl node not synced | Wait; ensure particld at height & staking enabled. |

| Monero refund failed | Lock time not reached | Wait until height >= refund_block. |

| "Insufficient balance" on offer take | Wallet locked or unconfirmed funds | Unlock wallet; send additional funds; rescan. |

| GUI shows stale orderbook | NAT/firewall blocking P2P | Open port 8449 TCP; enable UPnP; verify Tor circuit. |

11. Security & Privacy Tips

- Use Tor mode (

use_tor = 1) so IP doesn’t appear on offers. - Set

swaptempdirto an encrypted partition; logs may contain TXIDs. - Separate wallets for swap funds vs HODL cold storage.

- Watch swap progress; if GUI disconnects, leave daemon alive to avoid premature refund conditions.

- Verify HTLC script templates when upgrading versions (regression risk).

12. Upgrading BasicSwap

- Stop daemon:

./scripts/stop.sh. git pull && docker compose pull(orpip install -U basicswapfor venv).- Run migrations:

python basicswap/run.py --migrate(if prompted). - Restart.

Always backup ~/.basicswap/ before major upgrades.

13. Glossary

| Term | Meaning |

|---|---|

| HTLC | Hash‑Time‑Locked Contract; enables atomic swaps. |

| Secret / Pre‑image | Random 32‑byte string whose hash locks HTLCs. |

| Lock TX | Initial transaction funding an HTLC. |

| Redeem TX | Transaction claiming coins using secret. |

| Refund TX | Fallback transaction spending HTLC after timeout. |

| Order Depth | Amount of liquidity on a pair. |

14. Where to Get Help

- GitHub Issues: https://github.com/particl/basicswap/issues

- Matrix:

#basicswapdex:matrix.particl.io - Docs Wiki: https://academy.particl.io/en/latest/basicswap/

- Telegram relay (unofficial): Search “Particl Chat”.

15. Next Steps

- Run BasicSwap on testnet first (set

[BASE] network = testnetand use tBTC). Familiarize with refund path. - Fund mainnet wallets with small amounts and complete a live BTC ↔ XMR swap.

- Explore scriptless swaps (Schnorr adaptor sig) branch if you’re adventurous.

- Consider running a public liquidity provider bot to earn spreads.

Happy swapping—and remember: Not your exchange, not your privacy! 🔄🛡️